The founder of a popular credit repair company is facing several charges for running a massive credit fraud scheme.

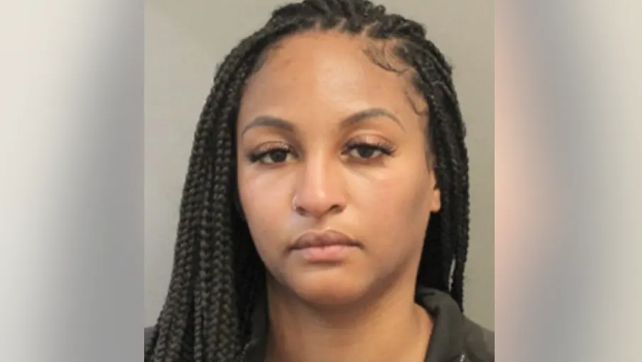

Houston entrepreneur Roekeicha Brisby is accused of removing negative items from her client’s credit reports using falsified police reports. According to investigators, Brisby would fix her client’s credit by telling the credit bureaus and financial institutions that they were the victims of identity fraud. She would then provide the fake reports with altered case numbers to get the debt removed for her customers, ultimately raising their credit scores.

Brisby falsified 133 police reports from the Harris County Precinct 4 Constable’s Office and submitted them to Discover Bank, First Credit Union, and Credit Central, among others. She defrauded these institutions out of $3.3 million through her Rose Credit Repair.

Valerie Cobio is one of Brisby’s clients who filed her own police report for an actual stolen identity case that occurred before she sought services from Rose Credit Repair. Brisby allegedly took that authentic report and copied it multiple times.

One institution became suspicious and raised its concerns to Harris County, which launched an investigation into the 29-year-old. During the probe, several of the clients claimed they were unaware that the police reports were being made on their behalf.

Constable Mark Hermann urges anyone who received credit services from Brisby and Rose Credit Repair to monitor their credit profiles, as creditors may reverse certain debts.

Brisby has been charged with forgery and fraudulent use of identifying information. She was denied bond since she was already out on bond for an injury to a child at the time of her latest arrest.