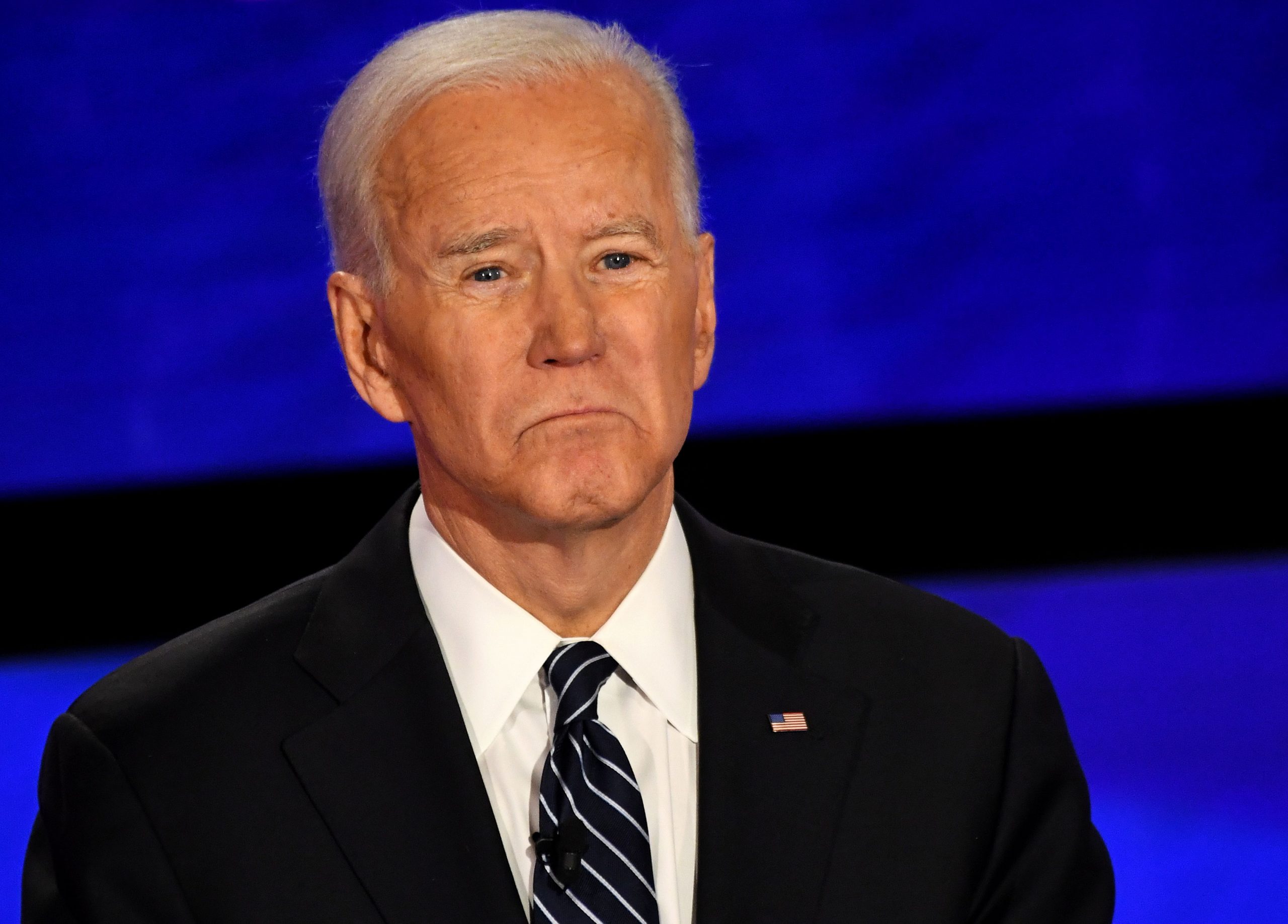

President Joe Biden has announced that the student loan forgiveness program will be expanded, a welcome relief for Americans struggling with debt.

On Tuesday, the Biden administration moved to offer more income-based repayment programs and full out unloading of the debt. These new measures will assist nearly 3.6 million student loan borrowers, according to a statement from the Department of Education. With the latest Public Service Loan Forgiveness Program revisions, at least 40,000 Americans will be granted instant debt forgiveness. The DOE wants to correct “historical failures” in the federal loan programs.

There are currently two types of systems for managing student loan debt: public service loan forgiveness (PSLF) and income-driven repayment (IDR). After ten years of on-time payments, the PSLF is supposed to forgive public officials’ educational debt. IDR plans were crafted to provide borrowers with affordable monthly payments based on their income and family size. Borrowers in these repayment programs can receive forgiveness after 20 to 25 years.

One major flaw in the system is that borrowers who would have been eligible for IDR plans were not made aware of all their options. Many lenders have engaged in “forbearance steering,” which encourages debtors to choose a forbearance program over an income-dictated repayment plan.

“Student loans were never meant to be a life sentence, but it’s certainly felt that way for borrowers locked out of debt relief they’re eligible for,” stated U.S. Secretary of Education Miguel Cardona.

The new forgiveness system arrived after the Biden administration fell under intense scrutiny for their handling of student loan repayments during the pandemic. In April, the administration announced that they’d be extending the pause on loan payments until August 2022.